Which of the Following Can Be Combined in Activity-based Costing

Analyzing and Recording Transactions. And Product Development with a total cost of 300000 and total activity of 20000 development hours.

Pin On Flevy Marketplace For Premium Business Documents

Multiple Choice O ABC ignores the allocation of storage tosts An activity cost pool collects costs related to the same activity ABC is more likely to result in big.

. To use this costing method one must first understand how costs are assigned to activities. A key concept underlying cost driver analysis is that a. It is activity-based costing so that the two products Z serum and W serum can be sold at their proper cost and make them price competitive in the market.

When designing an activity-based costing system related activities are frequently combined to reduce the amount of detail and record-keeping cost. Advertising and Sales Promotion. Activity-based costing serves and complements many other analyses and measures including target costing product costing product line profitability analysis service pricing and more.

Activity-based costing uses a number of activity cost pools each of which is allocated to products on the basis of direct labor-hours. Although the use of the ABC system. Organizationalfacility costs are non-value-added and should never be assigned to products or.

Advertising and Public Relations. The following formula can be used. Activities can be classified by the following methods.

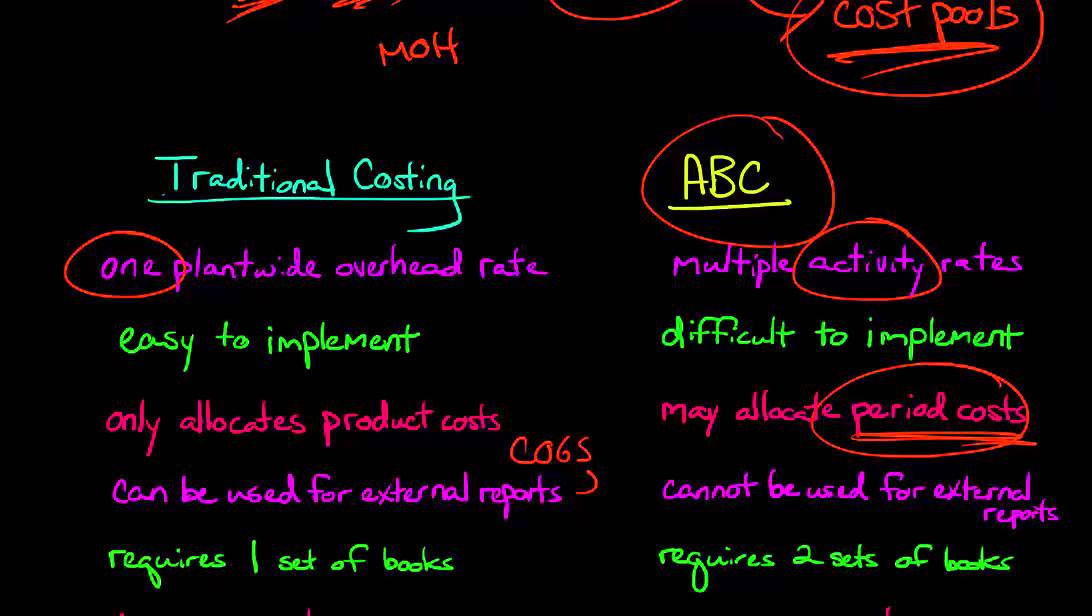

View the full answer. Thus it is used to better understand the companys true costs and thereby formulate an appropriate pricing strategy to mitigate unnecessary expenses. ABC costing systems are more complex and therefore more costly than traditional systems.

Using activity-based costing calculate the appropriate activity rate s 200000 25000. ABC costing systems allocate indirect costs to products based on the products. Power to run production equipment would be an __-level activity.

-setting up a computer network. Activity-based costing uses a number of activity cost pools each of which is allocated to products on the basis of direct labor-hours. Highly correlated activities In activity-based costing each cost pool accumulates costs that relate to a single activity measure in the ABC system.

O Activity-based costing systems tend to use fewer cost pools than does a traditional costing system. Activity Based Costing ABC. Two activity cost pools have been identified.

Which of the following can be combined in activity-based costing. An Activity cost pool co. The cost of measuring a driver does not exceed the benefits of using it.

O Traditional costing systems tend to be more costly than activity-based costing systems. When designing an activity-based costing system related activities are frequently combined to reduce the amount of detail and record-keeping cost. Adjusting Accounts for Financial Statements.

An Overview of International Business. Which of the following statements is true of costing systems. The use of the ABC system requires monitoring small details of activities and costs with more accuracy.

ABC costing systems can be used in manufacturing firms only. When the activities have been identified and classified facility product batch unit the next step is to combine similar activities into activity cost pools. Only costs occurring at the unit-level should be assigned to products or services.

100 9 ratings Answer is. Below are the production details that have been derived from the production sheet. Overhead for Cost Pool Cost Drivers x Amount of Activity Cost Driver.

The use of the ABC costing system requires us to identify the activities used in the production process and allocate the total fixed overhead based on the usage of activities by individual products. Indicators that an activity-based costing analysis may be appropriate include all the following except-Products are similar and consume resources in the same way-High-volume jobs show losses or minimal profits while low-volume jobs show healthy profits-Some manufacturing departments run at capacity while others have minimal operations. O Activity-based costing systems tend to combine various costs into a single cost pool.

Costs such as factory supplies and power to run machines could be combined in a cost pool based on the number of. All cost drivers identified should be used for cost accumulation. Analysis and Forecasting Techniques.

Customer Service with a total cost of 200000 and a total activity of 25000 customer service calls. Which of the following statements is true regarding activity-based costing systems. Which of the following statements is true of activity-based costing.

To keep the cost system manageable we must simplify the number of activities by grouping. Cost pool is a group of separate costs connected to a single activity.

4 2 Activity Based Costing Method Managerial Accounting Managerial Accounting Revision Guides Activities

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Cost Accounting Accounting Financial Freedom Quotes

Pin On Strategy Marketing Sales

Activity Based Costing Abc Accounting And Finance Cost Accounting Financial Management

Comments

Post a Comment